Blog > What Buyers Say They Need Most (And How the Market’s Responding)

What Buyers Say They Need Most (And How the Market’s Responding)

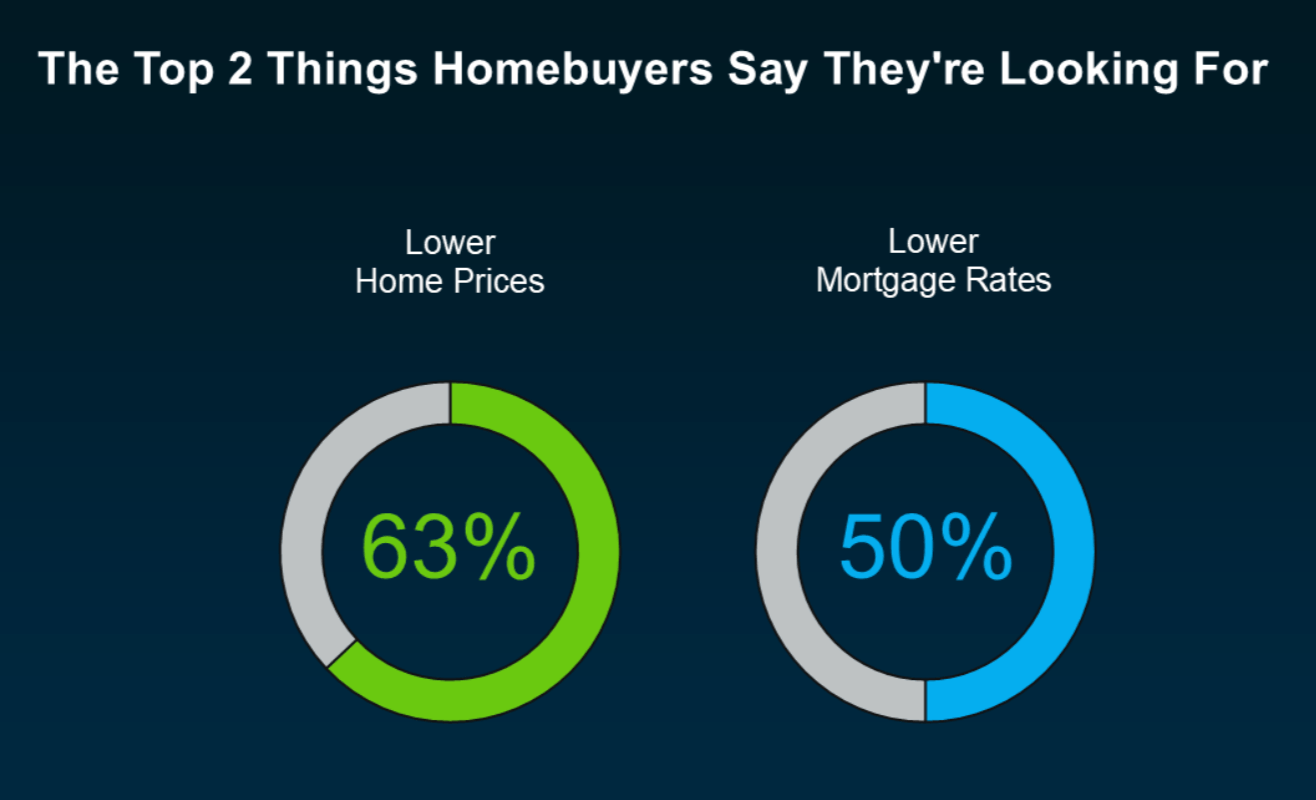

If you’ve been thinking about buying a home but waiting for the right time, you’re not alone. A recent survey from Bank of America found that most would-be buyers want to see one thing before making a move, better affordability. Specifically, they’re hoping for lower home prices and mortgage rates.

The good news? Both of those factors are finally showing signs of change. Let’s break down what’s happening in the market right now and what it could mean for you.

Home Prices Are Moderating

Over the past few years, home prices rose quickly, sometimes so fast that many buyers felt priced out. But that trend is starting to balance out. For example, between 2020 and 2021, national home prices jumped around 20% in just one year. Today, experts predict single-digit increases for the year ahead, a much more normal pace of growth.

That’s a big shift, and it’s giving buyers some breathing room. While prices aren’t dropping dramatically, they’re stabilizing enough to make budgeting and planning for a home purchase a little easier.

Keep in mind that local markets vary. Some areas may still see small price increases, while others could experience slight declines. But overall, we’re seeing a more balanced housing market than we’ve had in years.

Mortgage Rates Are Easing

Mortgage rates have also come down from their recent highs, and that’s another relief for homebuyers. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even a small decrease in mortgage rates can make a big difference in your monthly mortgage payment. While rates still fluctuate, most experts expect them to stay in the low to mid-6% range through the coming months, far better than what we saw not long ago. And depending on how the economy performs, we could even see rates dip further.

Why This Matters for Buyers

Confidence in the overall economy might still feel shaky, but the housing market is adjusting in positive ways. With moderating prices and easing mortgage rates, the window for homeownership may be opening wider again.

If you’ve been waiting on the sidelines, this could be your opportunity to revisit your home search and see what’s available within your budget.

Bottom Line

Both of the biggest affordability concerns, prices and rates, are showing signs of improvement. And those trends could continue as we move into 2026. If you’ve been wondering whether now’s a good time to buy, let’s chat. I’d be happy to walk you through what’s happening here in Logan County and the surrounding areas and help you figure out your next best step, whether that’s getting pre-approved, exploring listings, or just getting a feel for the market.

📞 Reach out anytime! I’m always here to help you make your move with confidence.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience