Blog > Do You Think the Housing Market’s About To Crash? Read This First

Do You Think the Housing Market’s About To Crash? Read This First

Lately, I’ve been getting the same question from a lot of folks: “Is the housing market about to crash?” If you’ve been watching the news or scrolling social media, I don’t blame you for wondering. The headlines can sound pretty alarming. According to a recent report from Clever Real Estate, 70% of Americans are concerned about a housing crash in 2025. But here’s the truth: The market isn’t crashing — it’s shifting. And that shift? It might actually be working in your favor.

Why the Market Is More Stable Than You Think

A big reason we’re not headed for a crash comes down to one thing: inventory. Mark Fleming, Chief Economist at First American, explains it like this: “There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

In other words, when there’s a shortage — like with concert tickets or the latest hot product — prices stay up. The housing market works the same way. Right now, there are still more buyers than available homes, and that imbalance keeps prices from falling.

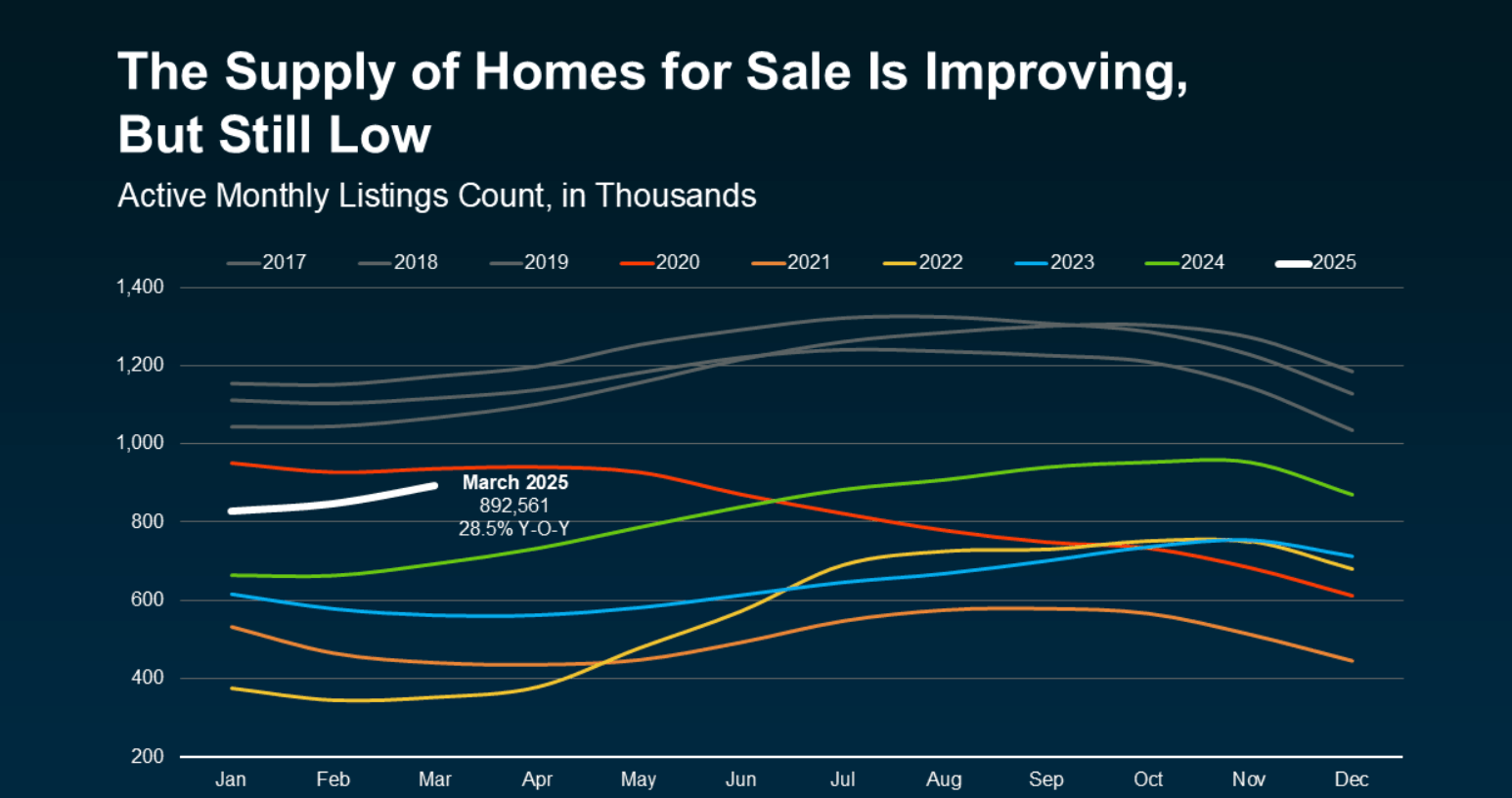

Yes, inventory is slowly increasing. But even with that rise, data from Realtor.com shows we’re still far below normal levels. That’s why home values remain steady, and why a major crash just isn’t in the cards.

More Homes on the Market = Slower, Healthier Price Growth

Now, let’s talk about what happens as more homes become available. When inventory starts to rise, it eases some of the intense upward pressure we’ve seen on prices over the past few years. That’s not a bad thing — in fact, it’s a sign of a healthier, more balanced market.

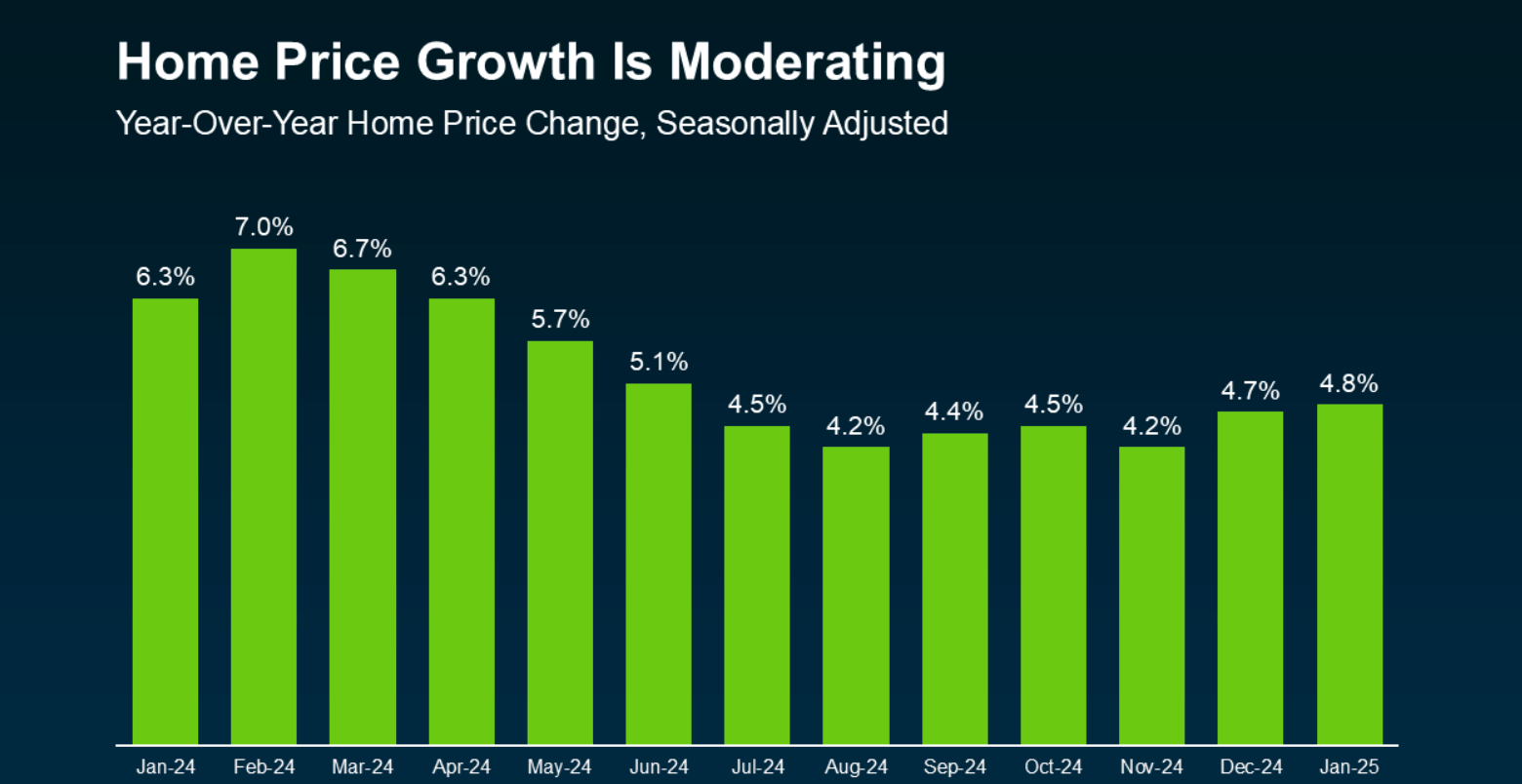

To be clear: home prices aren’t dropping nationally. But with more options out there, prices aren’t climbing at breakneck speed anymore either. What we’re experiencing now is something called price moderation — a much-needed slowdown in how quickly prices are increasing.

This kind of market shift can be great news, especially for buyers who’ve been feeling priced out or frustrated by bidding wars. And for sellers, it means you’re still in a strong position — just with a bit more competition to be mindful of.

What’s Next for Home Prices? A Slower, Steadier Climb

According to Freddie Mac, this trend of price moderation isn’t just a short-term blip — it’s expected to continue throughout the rest of the year: “In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

In plain terms: home prices will keep rising in most areas, just not as quickly as they have been. That’s a welcome change for buyers who’ve been hit with sticker shock in recent years — and a positive sign for long-term market health.

Of course, price trends and inventory levels vary from one market to the next. That’s why it’s so important to connect with a local expert who can help you understand exactly what’s happening in your area.

Bottom Line: The Market Isn’t Crashing — It’s Balancing

Despite the fear-driven headlines, the data and the experts agree: A housing crash in 2025 is highly unlikely. Business Insider puts it simply: “. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

What we are seeing is a market that’s becoming more balanced, more sustainable, and full of opportunity — especially if you have the right guidance. Whether you’re buying, selling, or just trying to figure out your next move, I’m here to help you make sense of the market and take your next step with confidence. Let’s talk about what this means for you, right here in Logan County.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience