Blog > Should You Really Stay for the 3% Mortgage Rate?

Should You Really Stay for the 3% Mortgage Rate?

If you’re sitting on a 3% mortgage, you’re not alone in feeling hesitant to give it up. Even if you’ve casually thought about moving, that little voice keeps asking: “Why would I let go of a rate that good?” It’s a fair question—but it might not be the most helpful one. Most people don’t move because of interest rates. They move because life changes. Needs shift. Families grow. Priorities evolve. So let’s reframe the question:

What Are the Chances You’ll Still Be in Your Current Home Five Years from Now?

Take a minute to think about your life five years from today:

-

Are you planning to expand your family?

-

Will the kids be moving out?

-

Is retirement on the horizon?

-

Are you craving more space, or less upkeep?

If your current home still fits your future, hanging onto it may be the right choice. But if there’s even a small chance you’ll need something different, it’s worth thinking ahead. Because timing matters—and waiting too long could cost you.

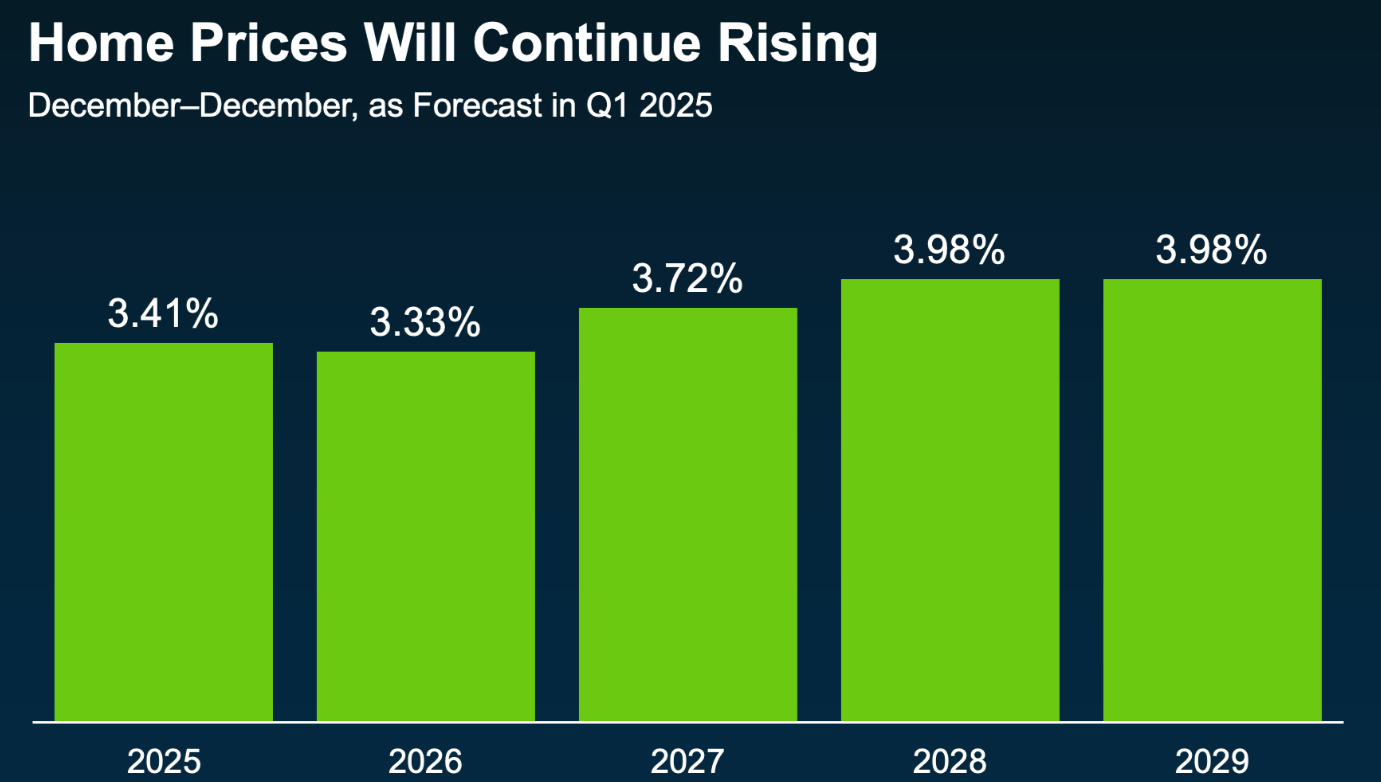

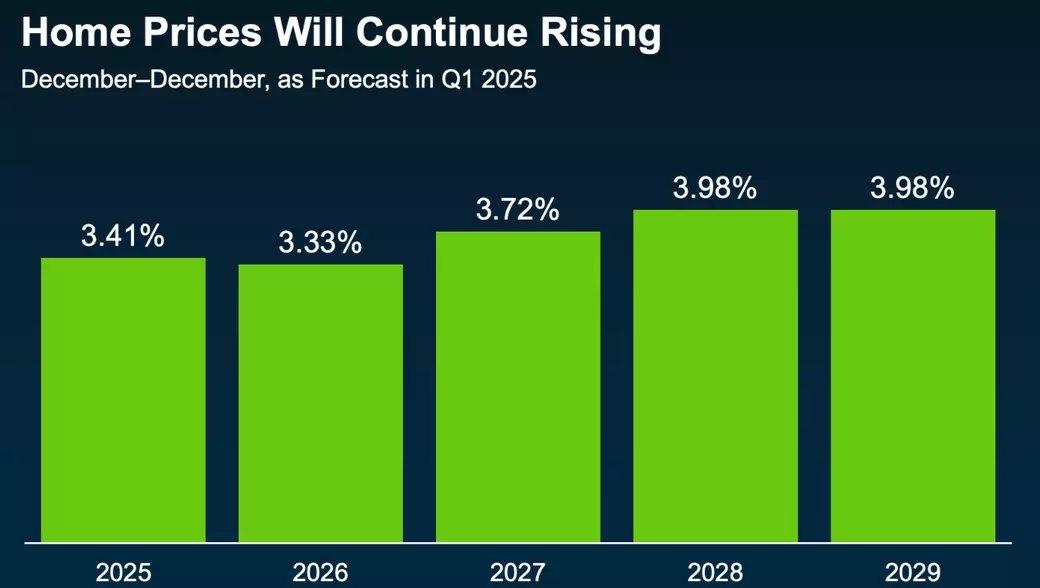

What the Experts Say About Home Prices

Every quarter, Fannie Mae surveys over 100 housing experts about where they see the market heading. The takeaway is clear: Home prices are expected to rise through at least 2029.

While annual increases might not be massive, they add up over time. Even in markets like ours where growth is steady rather than steep, the long-term trend still points up.

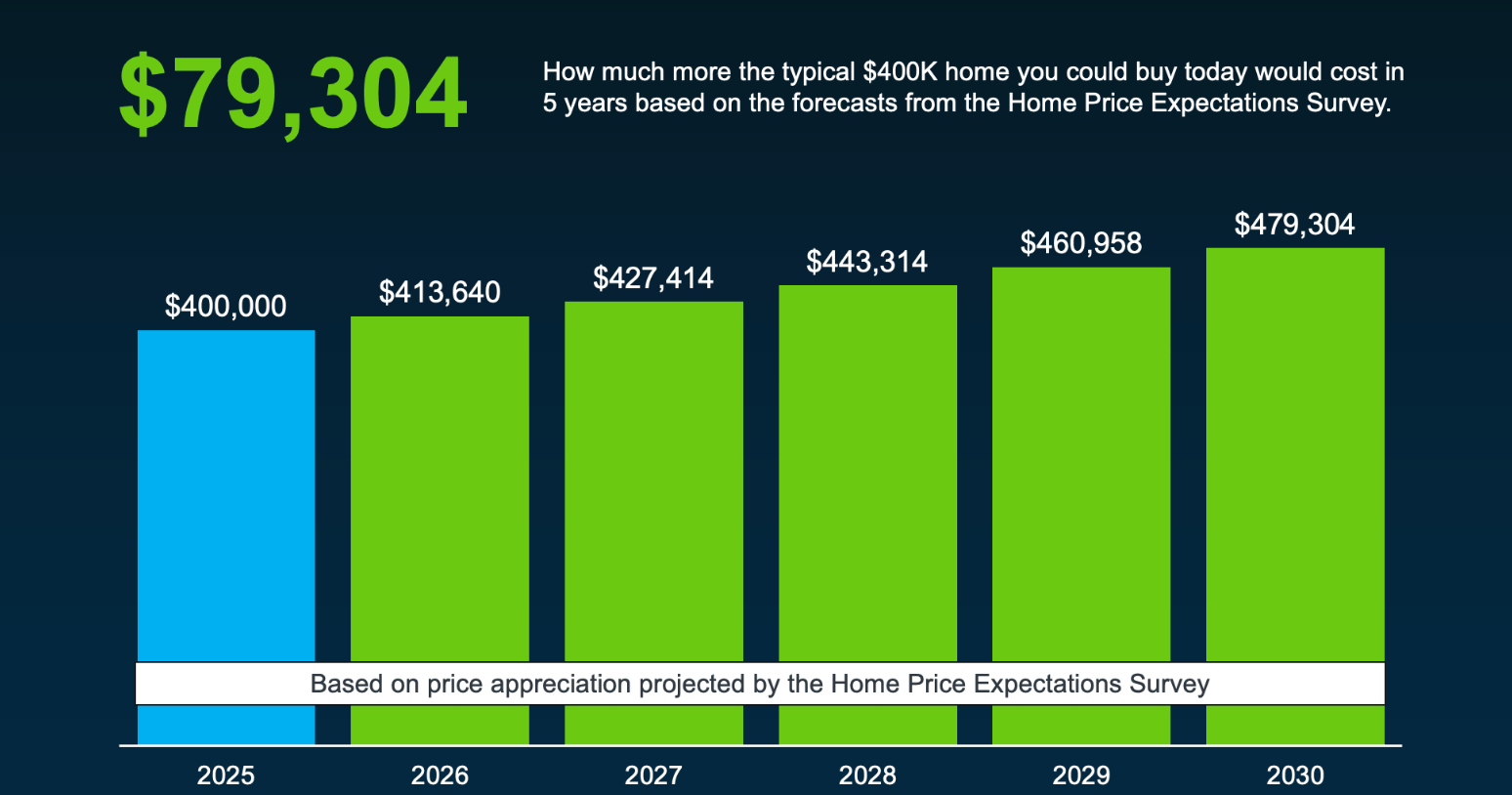

The Cost of Waiting: A Real-World Example

Let’s say you plan to buy a home around the $400,000 mark. If you wait five years to make that move, and prices climb the way experts expect, that same house could cost you nearly $80,000 more.

That’s a lot of extra money just for waiting—especially if your life would be better served by making a move sooner.

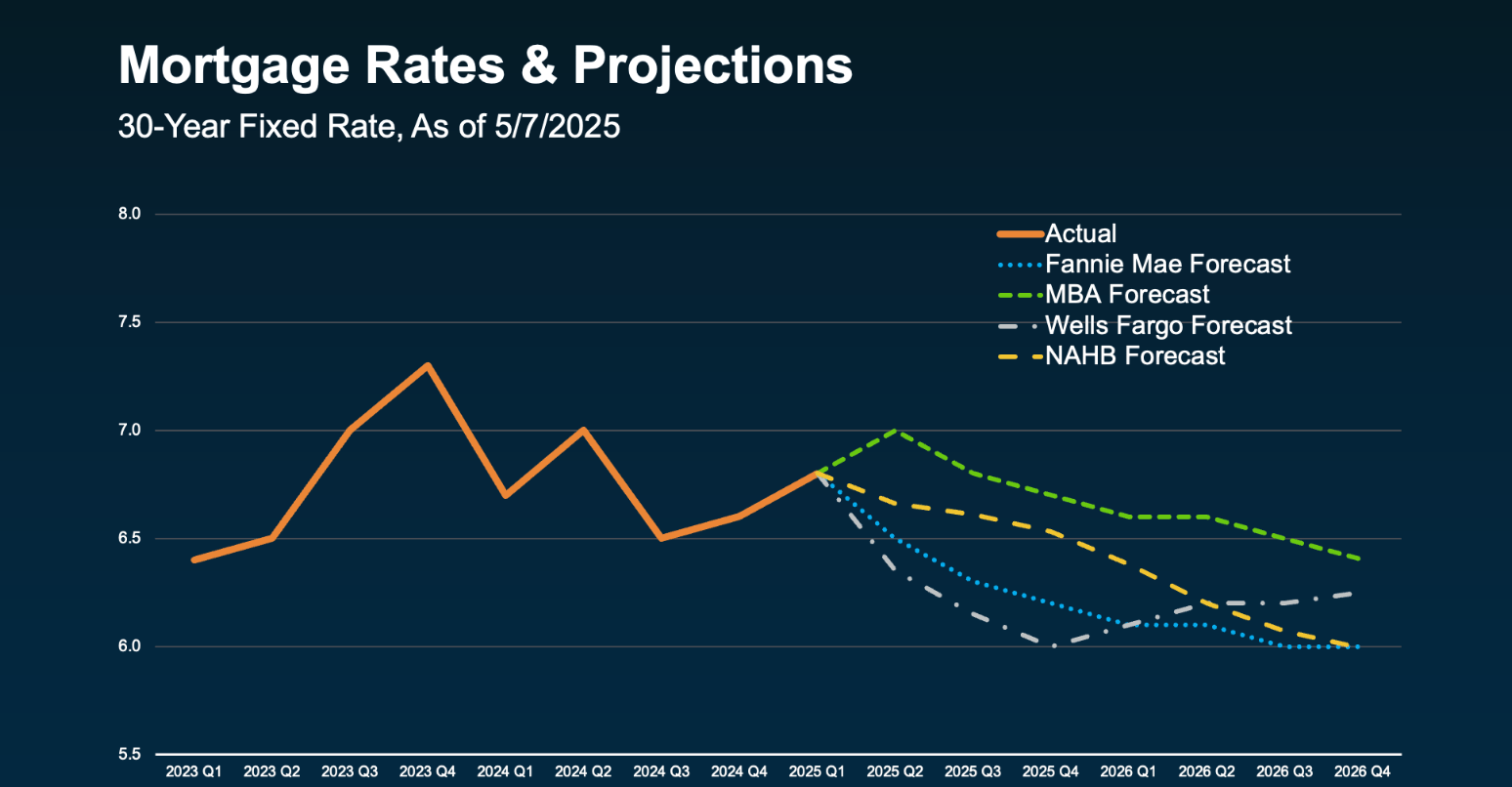

What About Mortgage Rates?

Yes, rates may come down a bit—but we’re not headed back to 3%. Industry projections show modest improvements in interest rates, but not the dramatic drop some buyers are holding out for.

So if you’re sticking around just to chase a better rate, it’s worth reevaluating that strategy. Especially if your home no longer suits your needs.

The Real Question to Ask: When Should You Move?

Your low rate might feel like an anchor, but it shouldn’t be a weight that holds you back from your next chapter. The smartest thing you can do right now? Have a conversation with a local agent. Go over your numbers. Explore your options. And make a decision that fits your life—not just your loan.

Bottom Line

That 3% mortgage rate served you well—but it shouldn’t be the only thing guiding your next move. If there’s a change on your horizon, whether it’s a year or five years away, now is the time to start planning. Knowing how prices, rates, and timing might affect your goals will help you make a move that’s both financially smart and aligned with where life is taking you.

Curious what these numbers look like for a different price point or area? Reach out. I'd love to run the numbers with you and help you decide the best path forward.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience