Blog > What a Government Shutdown Really Means for the Housing Market

What a Government Shutdown Really Means for the Housing Market

There’s been a lot of buzz lately about how a potential government shutdown could impact real estate. You might be wondering if it means everything in the housing world comes to a standstill.

Let’s clear that up right away — the short answer is no.

The housing market doesn’t stop. Homes are still being listed, shown, sold, and closed on every single day. While a few parts of the process may slow down temporarily, the overall market continues to move forward.

What Typically Happens During a Government Shutdown

When the federal government shuts down, some agencies temporarily close or reduce operations. That can create short-term delays in a few specific areas, especially when it comes to government-backed loans and flood insurance approvals.

Here’s what that usually looks like:

-

FHA, VA, and USDA loans – These loans rely on government processing, so applications may take longer than usual.

-

Flood insurance approvals – The National Flood Insurance Program can experience pauses, which may delay closings in designated flood zones.

-

Tax and employment verifications – Lenders sometimes face slower turnaround times getting these documents processed.

Even with those delays, most transactions still make it to the closing table. Buyers keep buying, sellers keep selling, and agents (like me!) keep helping clients move forward.

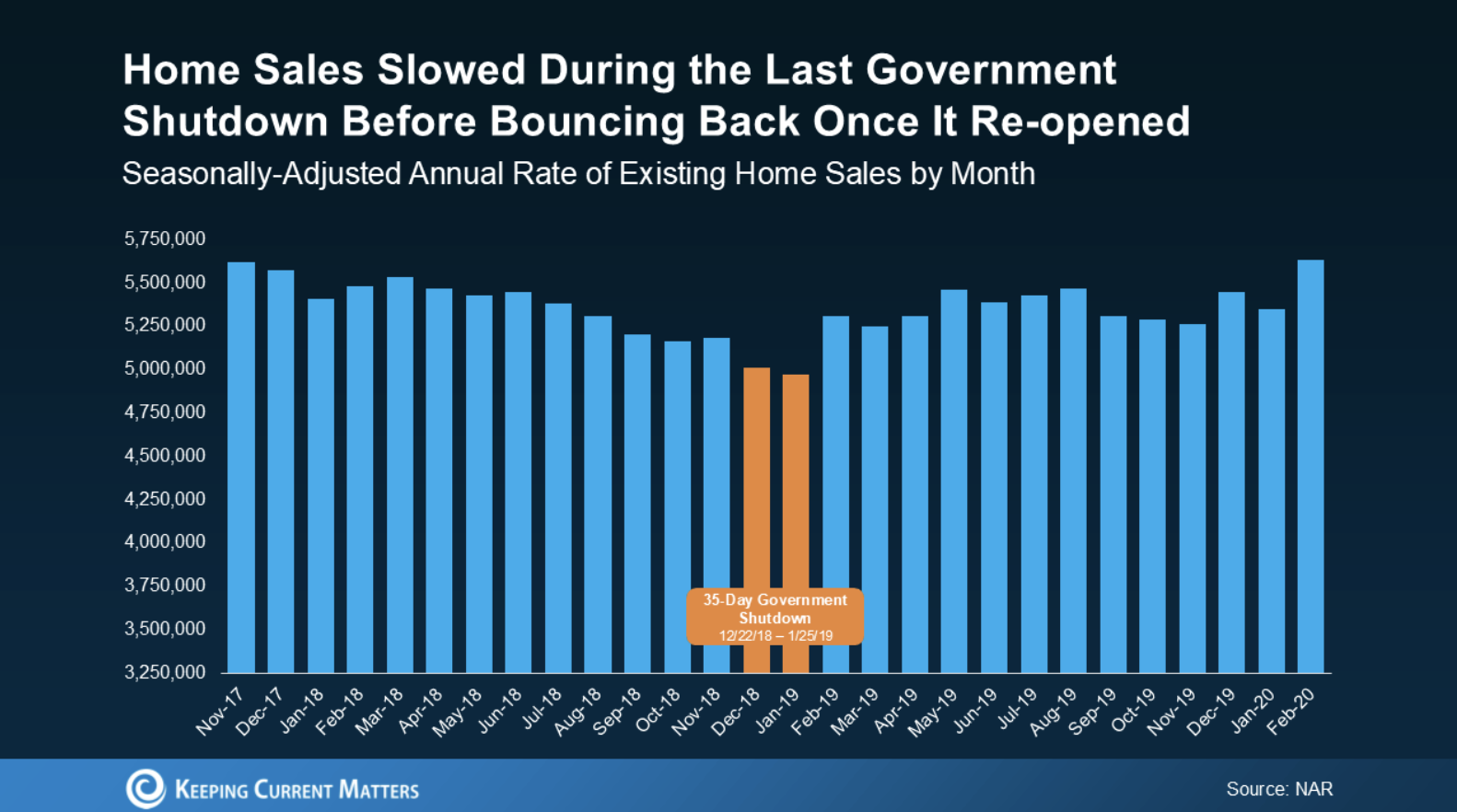

The Housing Market Usually Bounces Back Fast

If we look back at the most recent government shutdown at the end of 2018, home sales slowed slightly during the 35-day period, but quickly rebounded once things reopened. According to data from the National Association of Realtors (NAR), existing home sales dipped for a short window, then returned to normal levels as delayed closings caught up.

The key takeaway? Any slowdown is typically short-lived.

What This Means If You’re Buying or Selling

If you’re currently under contract, don’t panic. Most closings still move forward, even if they take a few extra days. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“If you’re expecting to close in a week or a month, there could be some slight delay, but for most people, it’s probably going to be a blip more than a real deal killer.”

If you’re just starting to think about buying or selling, this could actually work to your advantage. During uncertain times, some buyers and sellers may hit pause — meaning less competition and more negotiating power for those who stay active.

Brief slowdowns like this often create small windows of opportunity that disappear once confidence (and activity) returns.

Bottom Line

A government shutdown may cause temporary delays, but it does not stop the housing market. In fact, history shows that once the government reopens, the market bounces right back.

If you’re wondering how current events might affect your plans, or you just want to talk through your options, I’m here to help.

Let’s connect and make a plan that keeps you moving forward with confidence.

📞 Call or text me anytime to chat about your next move or the local market.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience