Blog > What Stabilizing Mortgage Rates Mean for You as a Buyer

What Stabilizing Mortgage Rates Mean for You as a Buyer

If you’ve been sitting on the fence about buying a home because of affordability concerns, you’re not alone. Between rising home prices and mortgage rates that felt like a moving target, the last couple of years have made home shopping feel like a gamble.

But here’s the good news: things are starting to level out—at least for now.

Mortgage Rates Are Holding Steady (Finally)

After months of big swings, mortgage rates have settled into a more predictable range. That may not seem exciting at first glance, but when you're planning something as major as buying a home, predictability is a huge win.

Since late last year, rates have stayed within about a half-percentage point range. We’re not seeing the dramatic ups and downs that made headlines throughout 2023, and that consistency is giving buyers a little more breathing room.

As HousingWire recently put it:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most 'calm' periods for mortgage rates in recent memory.”

Why That Matters for Buyers

When mortgage rates are volatile, it’s hard to plan. You may get pre-approved for one monthly payment, only to see that number jump by the time you’re ready to make an offer. With more stable rates, you can run numbers with a bit more confidence. You get a clearer picture of what your monthly payments might look like—and that helps take some of the stress out of the process.

Don’t Wait for the “Perfect” Rate

It’s natural to wonder if holding off could land you a better deal later. But most experts agree: trying to time the market usually doesn’t work out the way we hope.

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

— Jeff Ostrowski, Housing Market Analyst at Bankrate

Even if rates tick down slightly, it’s expected to be a slow and steady change, not a dramatic drop. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

What the Forecasts Say

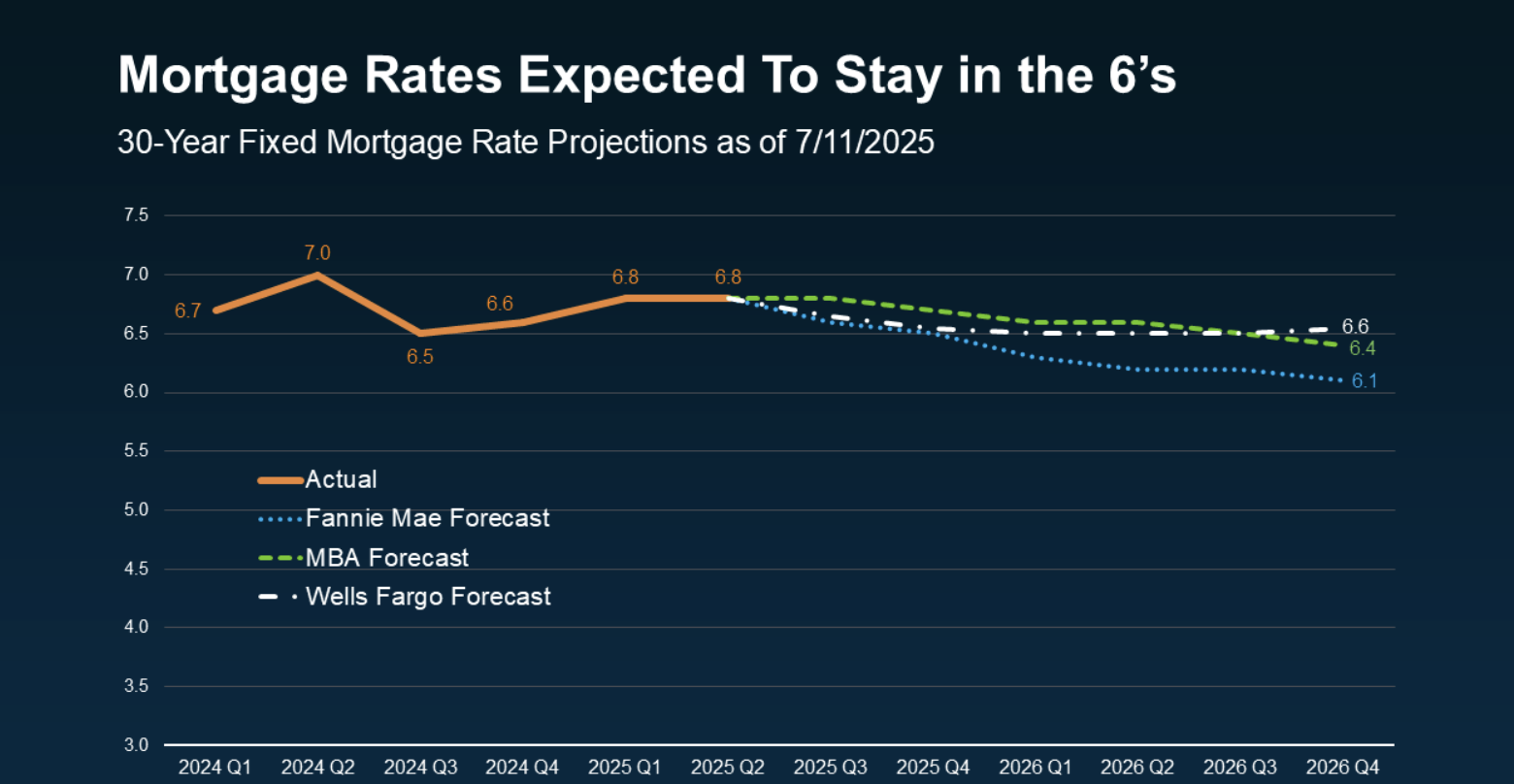

If you’re curious about where rates may be headed long term, take a look at this graph of expert projections through 2026. You’ll notice that most forecasts point to continued mid-6% rates well into the future.

That means the opportunity in front of you right now may not be all that different from what we’ll see next season or even next year.

The Bottom Line: More Stability Means More Confidence

While affordability is still a challenge, today’s market is offering something we haven’t seen in a while, predictability. And that can help you feel a whole lot more confident as you plan your next move.

Want to know what a mortgage payment would look like for the kind of home you’ve been dreaming about? Let’s talk. I’m happy to walk you through the numbers or get you in touch with a trusted lender. You don’t have to wait on the market to make your move, you just need the right information.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience