Blog > Is Your Home Worth More Than You Think?

When was the last time you checked the value of your home? For most people, it's not something that gets nearly as much attention as their bank account—but it should. Your home is likely your biggest financial asset, and its value may have increased more than you realize.

Let’s take a closer look at what that means for you.

Why Your Home’s Value Matters

If you’ve owned your home for a few years or longer, chances are it’s been quietly gaining value in the background. That growing value is known as home equity—and it could be a game-changer for your financial future.

So let me ask: When’s the last time you had a professional show you what your home is really worth?

What Is Home Equity?

Home equity is the difference between what your home is worth today and what you still owe on your mortgage. As home values rise and you pay down your loan, that equity grows.

For example:

-

Home Value: $500,000

-

Remaining Mortgage: $200,000

-

Equity: $300,000

That $300,000 is wealth you’ve built—whether you realized it or not.

In fact, according to Cotality (formerly CoreLogic), the average homeowner with a mortgage has around $311,000 in equity. That’s a powerful asset to have on your side.

Why You Might Have More Equity Than You Think

Here are two big reasons many homeowners are sitting on more equity than expected:

1. Home Prices Have Soared

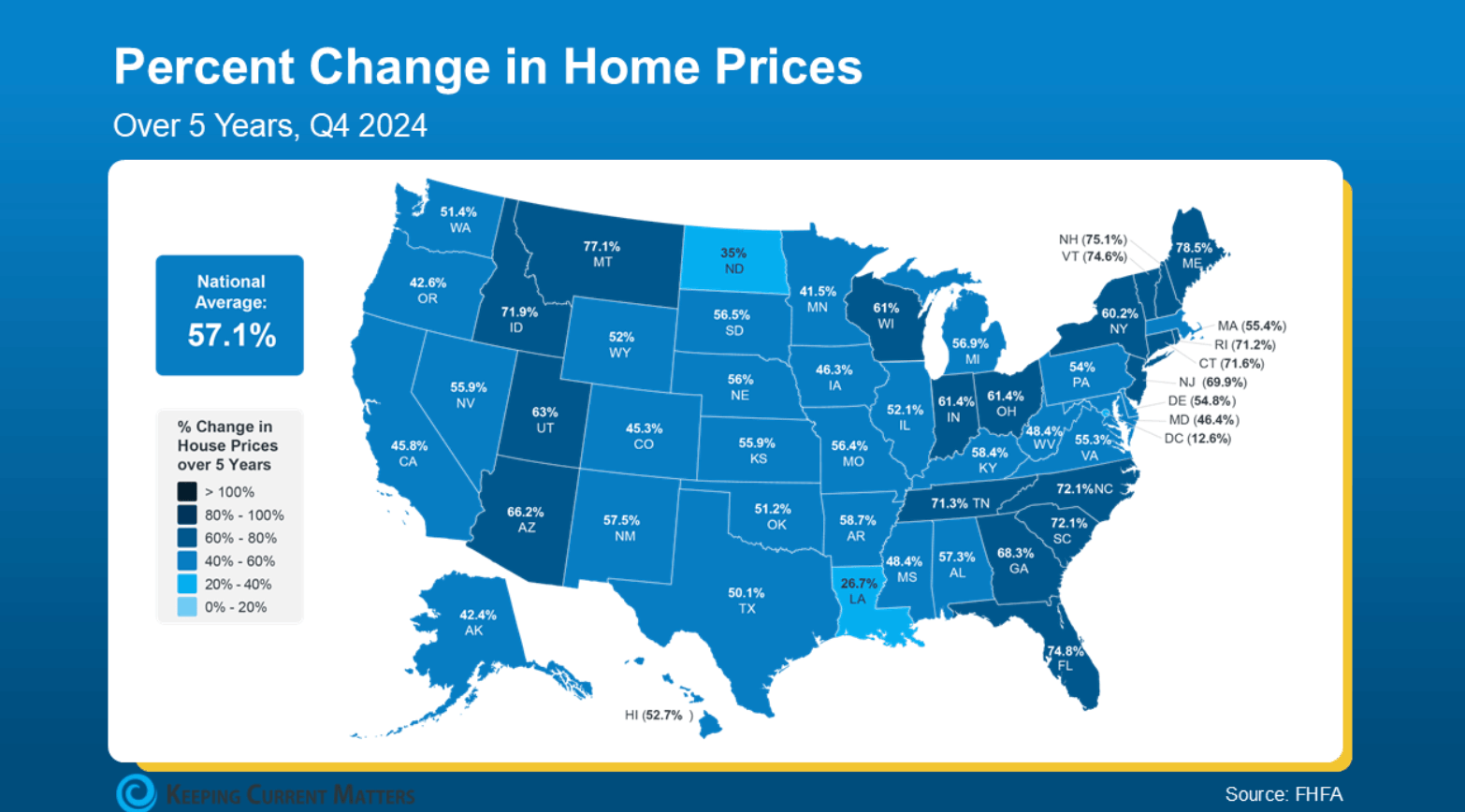

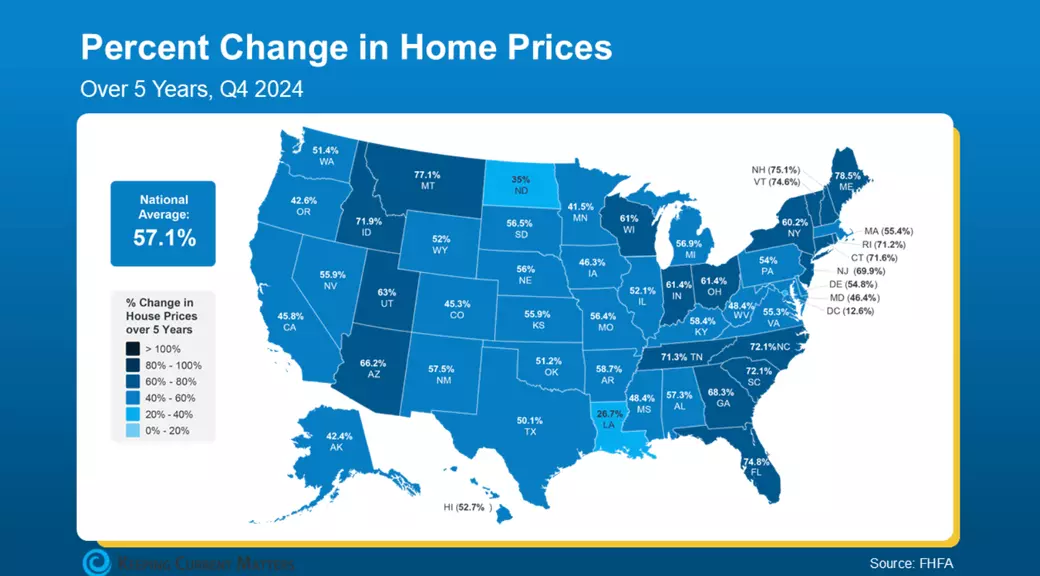

The Federal Housing Finance Agency (FHFA) reports that home prices have risen more than 57% nationwide over the last five years. If you bought your home even just a few years ago, it’s likely worth significantly more today.

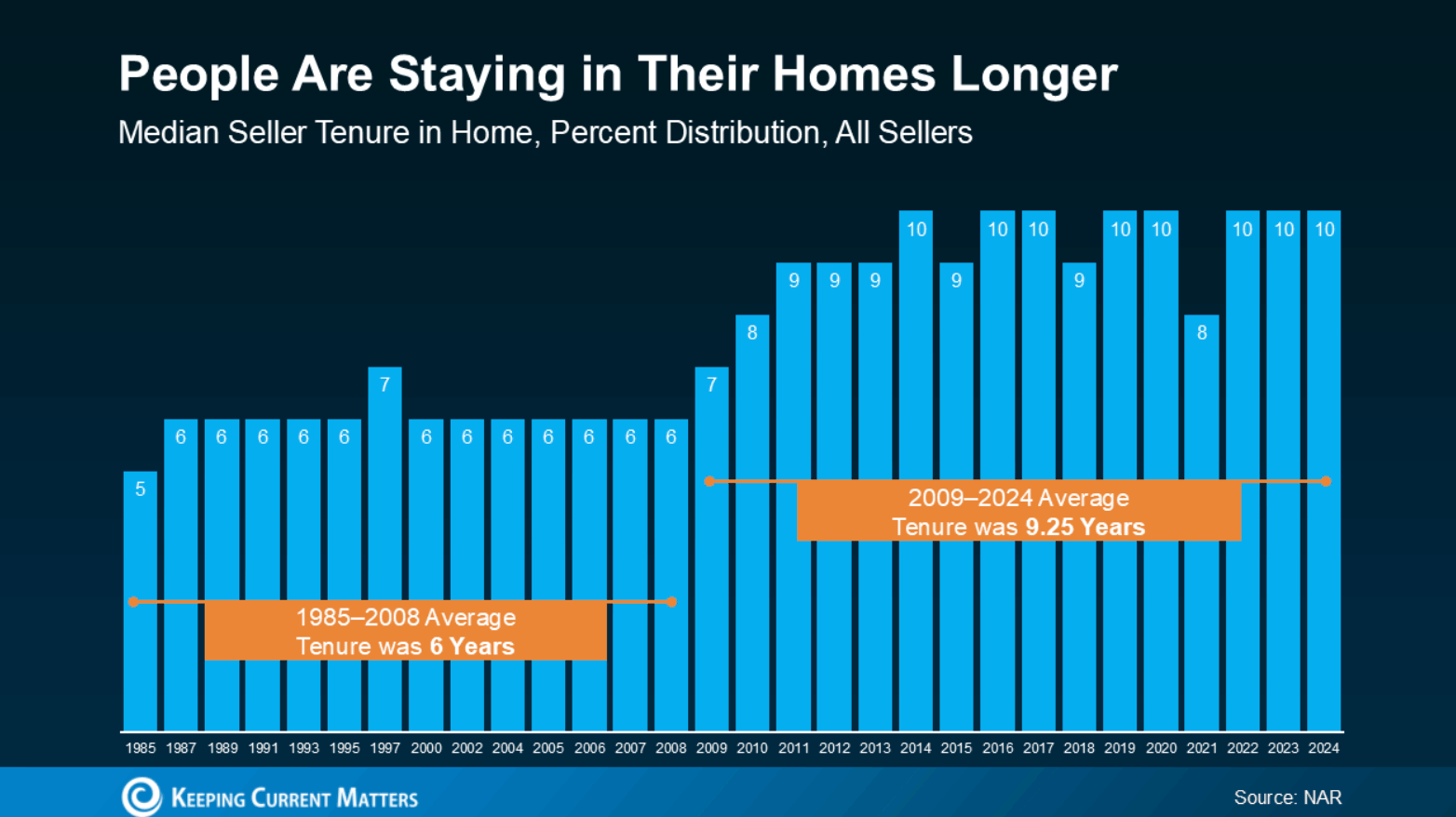

2. People Are Staying Put Longer

Homeowners are staying in their homes longer than they used to—on average, about 10 years. That means more time to pay down the mortgage and ride the wave of appreciation.

According to the National Association of Realtors:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What Can You Do With That Equity?

Your home equity isn’t just a number—it’s an opportunity. Here are a few ways you can put it to work:

-

Upgrade or downsize to a new home and use your equity as a strong down payment—or even buy in cash.

-

Renovate your current home to better fit your lifestyle. Smart updates can also boost your resale value.

-

Invest in your dreams, like starting a business, funding education, or diversifying your investments.

Let’s Find Out What Your Home Is Worth

Whether you’re planning your next move or just want a clearer picture of your financial health, knowing your home’s value is a smart step. I’d love to help you understand your current equity and what it could mean for your future.

Curious about what your home is worth in today’s market? Let’s talk.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience