Blog > 3 Reasons Affordability Is Showing Signs of Improvement This Fall

3 Reasons Affordability Is Showing Signs of Improvement This Fall

For the past couple of years, buying a home has felt out of reach for many people. Prices climbed higher, mortgage rates shot up, and a lot of buyers had to hit pause. Maybe you were one of them. But there’s good news: this fall, housing affordability is showing signs of improvement. If you’ve been waiting for the right time, this may be the opportunity you’ve been hoping for.

Why Affordability Is Improving

The cost of buying a home really comes down to three key factors:

-

Mortgage rates

-

Home prices

-

Your income

And right now, all three are finally moving in a better direction. While buying is still a big decision, it’s becoming more manageable than it was just a few months ago.

1. Mortgage Rates Are Easing

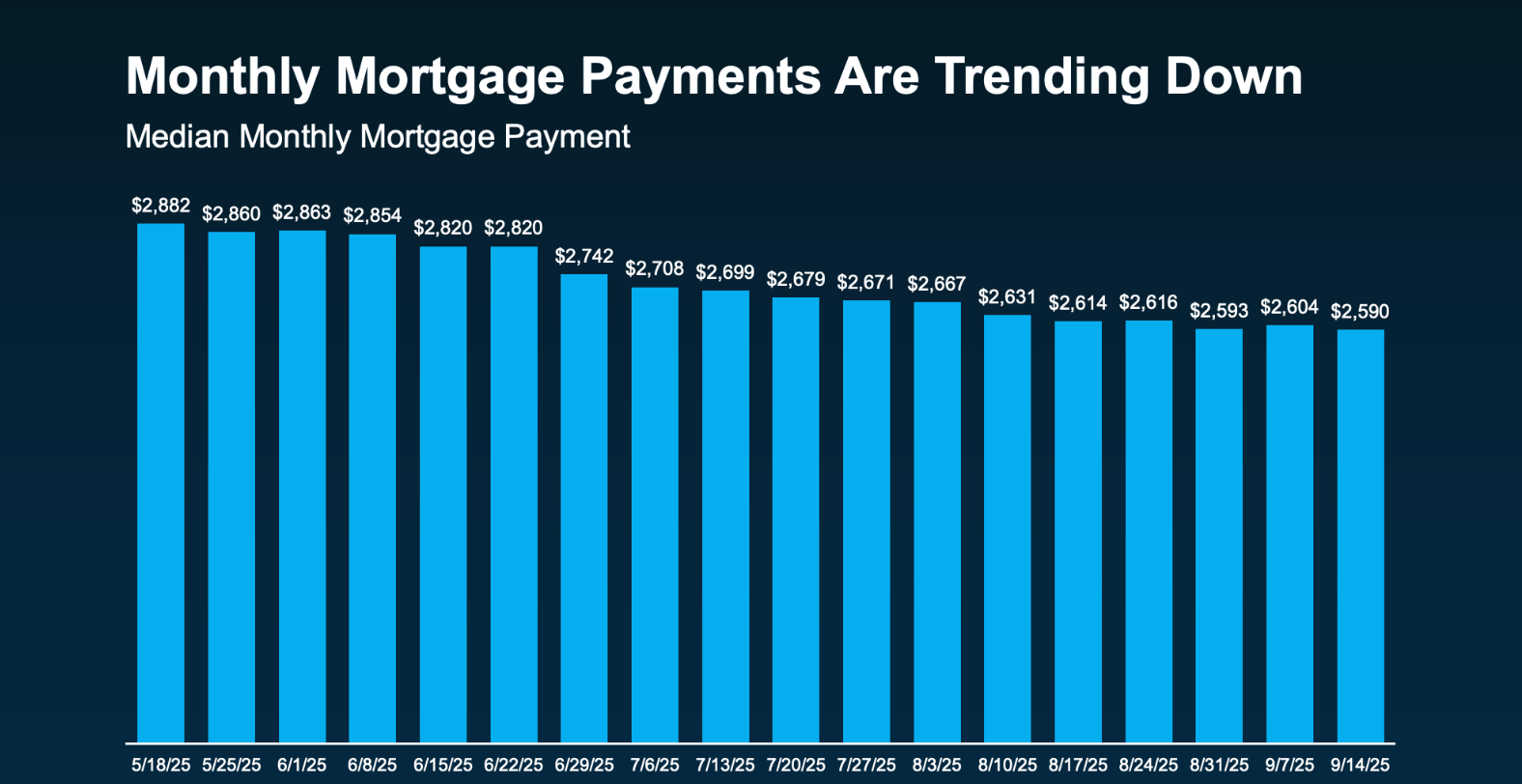

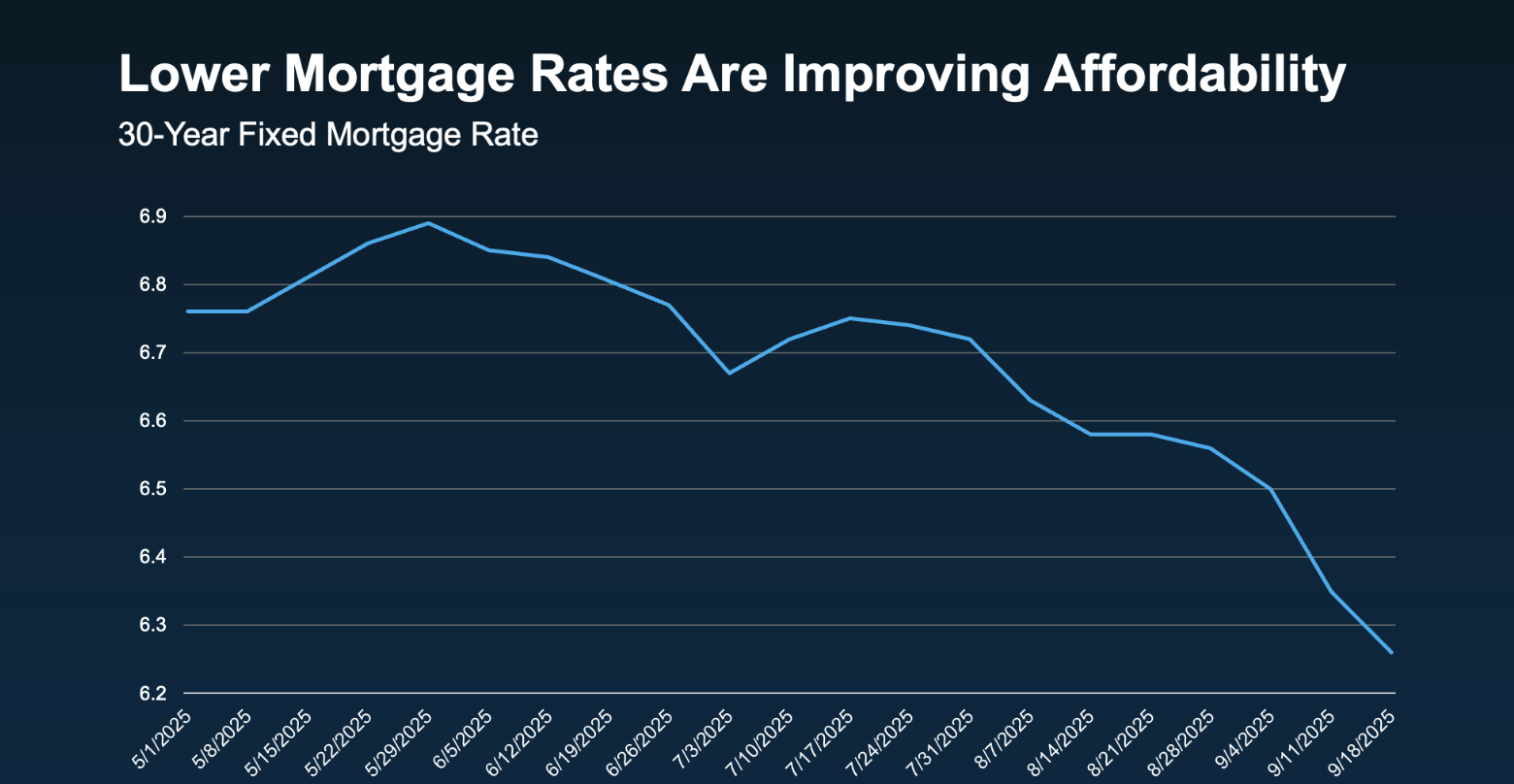

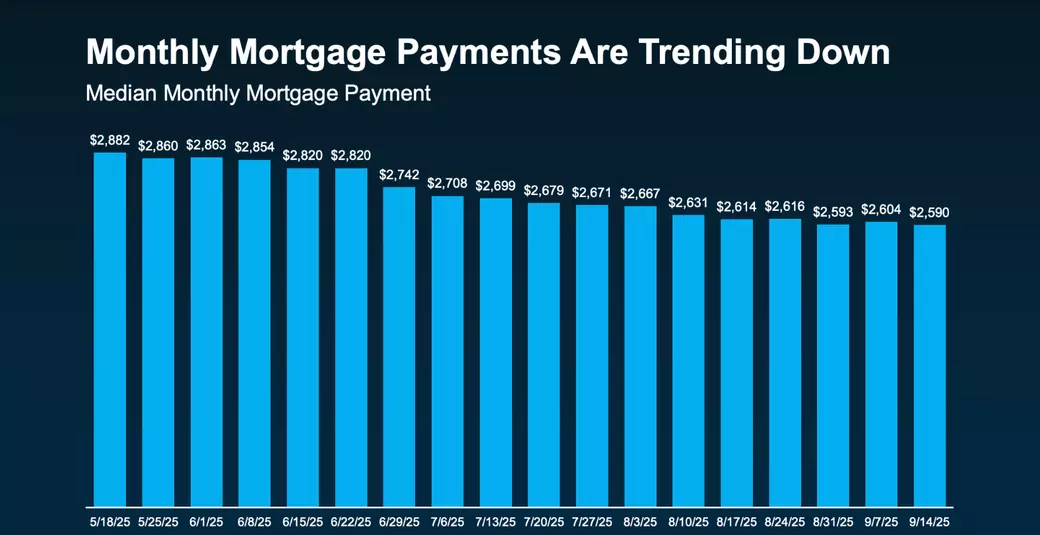

Mortgage rates have dropped from about 7% in May to closer to 6.3% today (see graph below). That small shift makes a real difference in monthly payments.

For example, on a $400,000 loan:

-

At 7% → Monthly payment would be significantly higher.

-

At 6.3% → You’d save around $190 per month.

That kind of savings has already encouraged more buyers to jump back in. In fact, the Mortgage Bankers Association reports purchase applications are up over 20% compared to last year.

2. Home Prices Are Leveling Off

After years of sharp increases, home price growth is slowing. In many areas, prices are now rising at only low single-digit percentages, and some markets are even seeing slight declines.

For buyers, that means:

-

More predictable budgeting

-

A chance to find better value

-

Less pressure of rising prices month after month

3. Wages Are Outpacing Home Prices

According to the Bureau of Labor Statistics, wages are rising at about 4% annually. At the same time, home price growth has slowed. That gap makes homes more affordable compared to where we were a year or two ago.

As NAR’s Chief Economist Lawrence Yun says:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

What This Means for You

Put it all together—lower rates, steadier home prices, and stronger wages—and it’s clear that buying a home is more realistic this fall than it has been in recent years.

According to Redfin, the typical monthly mortgage payment is now about $290 less than just a few months ago. That’s money back in your pocket each month.

Bottom Line

If you’ve been on the sidelines, now is the time to revisit your homebuying plans. Even small shifts in the market can make a big difference in what you can afford.

The smartest next step? Sit down with a local expert who can walk you through your budget, show you today’s opportunities, and help you decide if it’s time to make a move.

👋 I’m your local real estate agent here to guide you through the process. If you’re curious what these changes mean for you, let’s connect and run the numbers together. This fall could be the season you finally find the home you’ve been waiting for.

GET MORE INFORMATION

Haley Team

Director of Agent Success & Client Experience

Director of Agent Success & Client Experience